Eurozone PMI, GDP growth and solvency of the Eurozone

Recent Forex trading news highlights the continued fragile state of both the European and United States economies. Nonetheless, the US dollar varied in narrow ranges as liquidity tightens ahead of the July 4th bank holiday in America.

Recent Forex trading news highlights the continued fragile state of both the European and United States economies. Nonetheless, the US dollar varied in narrow ranges as liquidity tightens ahead of the July 4th bank holiday in America.

Eurozone PMI

Across the Atlantic in Europe, many online traders are eager to hear what the ECB and the Bank of England will state in their monthly policy announcements. Most traders foresee additional easing on both sides. Another point of interest is the release of the Eurozone PMI data in the coming days. Most expect this data to be bearish; showing not only that economic activity across Europe shrank for the fifth consecutive month but that also the rate of contraction in June will equal that of May.

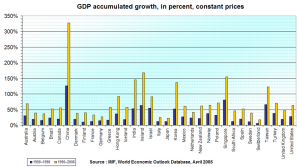

GDP growth

The cut in GDP growth expectations underpins the fact that most traders are not surprised by any negative data being released. Rather, they are now more focused on policy changes intended to mitigate this downturn. Thus, any information released is actually expected to change little until the anticipated rate decisions previously mentioned are made pubic. However, due to the fact that there is relatively little trading volume currently, any smaller movements can be amplified. Forex traders should be aware of this and not view such movement as a trend but rather short term volatility.

Solvency of the Eurozone

Although these headlines will garner much attention from both traditional and online Forex traders, overall sentiment and longer term concerns still focus on the solvency of the Eurozone itself; particularly both Spain and Italy. Safe haven investing remains the policy for many traders and their outlook still can be viewed as bearish for the short to medium term.