Posts Tagged ‘EUR/USD’

Tuesday, November 10th, 2015

A considerable amount of attention by online Forex traders has centred around the relationship between the United States dollar and the euro. There continues to be a significant amount of speculation in regards to the monetary strategies employed by the Federal Reserve in relation to the actions of the ECB.

In particular, surprisingly robust employment figures out of the United States have hinted that the Fed may hike interest rates in December.

(more…)

Tags: deposit rates, ECB, EUR/USD, Federal reserve, USA

Published in Euro, Interest rates, News, Political, usd | No Comments »

Monday, June 3rd, 2013

Foreign exchange currencies change in just a few seconds. This trading option is more volatile than ever as more transactions are currently in process. There are yet economic changes this week as analysts see the potential of short term charts. This would provide further opportunities for big levels to watch out for.

Foreign exchange currencies change in just a few seconds. This trading option is more volatile than ever as more transactions are currently in process. There are yet economic changes this week as analysts see the potential of short term charts. This would provide further opportunities for big levels to watch out for.

The EUR/USD has low volatility with a low level of 1.3000 so no other expectations are to be seen until this week. The best currency for long-term outlook is the EUR/USD since it still ranges from 1.2800 to 1.3200. Added to that, the RSI and the short term average are on neutral as technically seen in the chart.

(more…)

Tags: economic indicators, EUR/USD, USD Construction Spending, USD ISM Manufacturing, USD Markit US PMI Final

Published in Dollar, Euro, Statistics, trading | No Comments »

Monday, January 28th, 2013

It seems that many investors feel that the euro has turned a rather pivotal corner during this past week. The multinational currency finished off the week of the 21st at a ten month high in relation to the dollar.

It seems that many investors feel that the euro has turned a rather pivotal corner during this past week. The multinational currency finished off the week of the 21st at a ten month high in relation to the dollar.

This has been interpreted by many as a sign of a heightened sense of confidence in the European banking sector.

There are even rumours that we may see the euro currency test the 2012 resistance levels of $1.35 in the short-term. Nonetheless, the week ahead is of critical importance for the perceived strength of the euro.

(more…)

Tags: cpi report, EUR/USD, Euro, Federal Open Market rate, Nonfarm Payroll Data

Published in Dollar, Euro, usd | No Comments »

Tuesday, January 15th, 2013

It seems that the new year has once again brought the bears out in regards to the latest online forex trading sentiment. The Euro has lost any previous gains made against the dollar due to a larger fall in European Union industrial output than previously predicted.

It seems that the new year has once again brought the bears out in regards to the latest online forex trading sentiment. The Euro has lost any previous gains made against the dollar due to a larger fall in European Union industrial output than previously predicted.

This statistical pullback is highlighted by the continued record-high unemployment in countries such as Spain and Greece. Although unemployment remains one of the most bearish economic barometers for the Euro, weak private sector output serves to further illustrate the fragile state of this multinational economy.

(more…)

Tags: ECB, EUR/USD, European Central Bank, us dollar

Published in Dollar, Euro, Political, usd | No Comments »

Friday, September 14th, 2012

Euro rises to a 4-month high against the Dollar as the German Constitutional Court Approves of a multi-billion Euro Rescue Plan

The German constitutional court on 12 September, 2012 approved of the German government’s participation in the Euro zone’s latest rescue plan, pushing the Euro to a 4-month high against the dollar and other currencies. The Court allowed the government to contribute as much as €190 billion Euro to the rescue plan without having to take permission from the German parliament. These terms buoyed the sentiments in the forex market, which was expecting tougher terms from the Court.

German court verdict supporting EURO raise

Within hours of the Courts verdict, the Euro rose 0.35% against the US dollar to close at 1.2899. It continued to rise on 13th September, when it closed at 1.2985. (more…)

Tags: ECB, EUR/USD, germany

Published in Euro, GBP, usd | No Comments »

Thursday, August 23rd, 2012

In the latest forex news, the US dollar has slid considerably in comparison to other major currencies.

In the latest forex news, the US dollar has slid considerably in comparison to other major currencies.

While earlier this month many forecasts were bullish regarding the dollar’s upward trend, analysts have now scaled off this position and are taking a more contemplative approach.

Indeed, the dollar may slide further as is possibly indicated by the relative strength index (RSI) which appears to be setting the stage for a downward trend in the weeks to come. This is especially relevant considering that the Jackson Hole Economic Symposium is on schedule for the following week.

Although the bearish stance for the dollar may continue temporarily, should chairman Bernanke not hint at another round of QE3, sentiments may begin to reverse.

(more…)

Tags: Dollar, EUR, EUR/USD, Euro, outlook, United States, us dollar, USA, usd

Published in Currencies, Dollar, Euro, usd | 1 Comment »

Monday, August 13th, 2012

Hosting the 2012 Olympic Games cost the British government an estimated £9.3 billion. While this may seem like an exorbitant amount, history has shown that hosting the Olympics can not only be a matter of prestige for a city, but also stimulate local economies and boost tourism, thus providing long term economic benefits.

Hosting the 2012 Olympic Games cost the British government an estimated £9.3 billion. While this may seem like an exorbitant amount, history has shown that hosting the Olympics can not only be a matter of prestige for a city, but also stimulate local economies and boost tourism, thus providing long term economic benefits.

British Olympic medal’s impact on cash reserves

The 2012 London Olympics have provided much needed cash reserves to the beleaguered British economy, which announced earlier in July that GDP output fell by 0.7 percent in the second quarter of the year. The games have been very successful, thanks in part to the British team’s exceptional performance.

(more…)

Tags: 2012 London Olympics, Dollar, EUR/USD, london olympics

Published in Euro, GBP | No Comments »

Tuesday, August 7th, 2012

Dominating Forex trading news is the Euro’s continued decline versus the dollar. The new low of 1.229 has hit many traders and this trend is predicted to continue for some time. The faltering of the Euro is seen to have been partially caused by fresh Greek unemployment figures, this data now showing that the number of jobless youths in Greece has hit a record high.

Dominating Forex trading news is the Euro’s continued decline versus the dollar. The new low of 1.229 has hit many traders and this trend is predicted to continue for some time. The faltering of the Euro is seen to have been partially caused by fresh Greek unemployment figures, this data now showing that the number of jobless youths in Greece has hit a record high.

(more…)

Tags: bonds, Dollar, ECB, EUR/USD, European Central Bank, italy, portugal, spain

Published in Dollar, Euro, GBP, usd | No Comments »

Tuesday, July 24th, 2012

The week ahead looks to highlight concerns underpinning the European sovereign debt situation. The main story still is that of volatility on the European market; the single currency’s future viability questioned by many traders worldwide.

Spain is becoming more and more of a concern

The concerns with Spain’s ability to manage a flailing economy have grown since the IMF rescue package was approved. Spanish yields have tipped well over seven percent, trading at 7.39% after hitting a European-era high of 7.56%. Attempting to mitigate further volatility, Spain has banned short selling for three months while Italy, feeling the effects as well has banned short selling financials for one week. There are now fears that Spain may indeed seek a full bailout, as regional governments have begun to express concern for their ability to manage internal debts. Spanish and Italian bank shares were the worst hit followed closely by their domestic indices; the Ibex at one point dropping nearly five percent.

The concerns with Spain’s ability to manage a flailing economy have grown since the IMF rescue package was approved. Spanish yields have tipped well over seven percent, trading at 7.39% after hitting a European-era high of 7.56%. Attempting to mitigate further volatility, Spain has banned short selling for three months while Italy, feeling the effects as well has banned short selling financials for one week. There are now fears that Spain may indeed seek a full bailout, as regional governments have begun to express concern for their ability to manage internal debts. Spanish and Italian bank shares were the worst hit followed closely by their domestic indices; the Ibex at one point dropping nearly five percent.

Greece’s debt reduction

Furthermore, creditors are expected to begin auditing Greece’s progress on debt reduction. This audit determines whether the country is to be approved for an additional 31.5 billion euros. With political and social unease, a quickly shrinking economy and many investors questioning whether Greece will meet its August deadline, there has been speculation of true insolvency should their financial situation worsen.

Furthermore, creditors are expected to begin auditing Greece’s progress on debt reduction. This audit determines whether the country is to be approved for an additional 31.5 billion euros. With political and social unease, a quickly shrinking economy and many investors questioning whether Greece will meet its August deadline, there has been speculation of true insolvency should their financial situation worsen.

EUR/USD at two-year low

Because of these protracted jitters, the euro has fallen to a two-year low against the US dollar to trade at $1.2082. Furthermore, it has fallen to an eleven-year low to the Japanese yen. Below $1.20, many online Forex traders have taken a bearish stance.

Because of these protracted jitters, the euro has fallen to a two-year low against the US dollar to trade at $1.2082. Furthermore, it has fallen to an eleven-year low to the Japanese yen. Below $1.20, many online Forex traders have taken a bearish stance.

Euros long term survival

On the other hand, some Forex traders have taken the attitude that any position would have to be long due to such market volatility. This, of course, is under the assumption that the euro will remain in its current form. Indeed, the lack of real movement in the precious metals markets, traditional safe havens, illustrates that many believe the markets may incur still more losses in the near term. Nonetheless, taking a long position in the euro may indeed be one of the few hedges against what remains as the most volatile era for decades.

On the other hand, some Forex traders have taken the attitude that any position would have to be long due to such market volatility. This, of course, is under the assumption that the euro will remain in its current form. Indeed, the lack of real movement in the precious metals markets, traditional safe havens, illustrates that many believe the markets may incur still more losses in the near term. Nonetheless, taking a long position in the euro may indeed be one of the few hedges against what remains as the most volatile era for decades.

Tags: debt reduction, EUR, EUR/USD, Euro, greece, IMF, spain, us dollar, usd

Published in Crisis, Dollar, Euro, Political | No Comments »

Sunday, July 15th, 2012

In recent Forex trading news, it is clear that all eyes continue to be on the economies of both Spain and Italy. Although the ECB’s intervention into the Spanish sovereign debt crisis initially raised investor sentiment, a subsequent backslide occurred, causing Spanish bond rates to hover near the dangerously high level of 7 percent. If we combine this factor with Spain’s request to be given more time to reach its deficit targets in exchange for further domestic austerity measures, (more…)

In recent Forex trading news, it is clear that all eyes continue to be on the economies of both Spain and Italy. Although the ECB’s intervention into the Spanish sovereign debt crisis initially raised investor sentiment, a subsequent backslide occurred, causing Spanish bond rates to hover near the dangerously high level of 7 percent. If we combine this factor with Spain’s request to be given more time to reach its deficit targets in exchange for further domestic austerity measures, (more…)

Tags: ECB, EUR/USD, European Central Bank, italy, spain, spanish bonds, ZEW

Published in Euro, News, usd | No Comments »

Wednesday, June 27th, 2012

The German Unemployment Report is expected to support the bleak outlook for the Eurozone as unemployment in the area’s largest economy is forecasted to increase in June. Undoubtedly, the forecast for the Eurozone is not a rosy one, especially considering Greece is expecting a 9% contraction of their (more…)

The German Unemployment Report is expected to support the bleak outlook for the Eurozone as unemployment in the area’s largest economy is forecasted to increase in June. Undoubtedly, the forecast for the Eurozone is not a rosy one, especially considering Greece is expecting a 9% contraction of their (more…)

Tags: china, EUR/USD, france, germany, greece, Home Sales Index, spain, unemployment rate

Published in Euro, Political, usd | 1 Comment »

Monday, June 25th, 2012

This past week has seen a number of financially important events; from Greek election results to Spanish bonds surpassing all-time highs. Any signals of enthusiasm regarding Greece’s elections quickly faded and the overall value of the Euro has continued on a downward trend. The forex bears still seem firmly in place in both European and international market trading.

This past week has seen a number of financially important events; from Greek election results to Spanish bonds surpassing all-time highs. Any signals of enthusiasm regarding Greece’s elections quickly faded and the overall value of the Euro has continued on a downward trend. The forex bears still seem firmly in place in both European and international market trading.

While the immediate threat of an imminent Greek default being averted initially caused a slight rally in European markets, a broader analysis revealed investors’ sentiment still remains shaky; (more…)

Tags: Dollar, EUR/USD, Euro, online forex trading, spanish bonds, trading signals

Published in Dollar, Euro, News | 1 Comment »

Monday, September 27th, 2010

After weeks of gains, Euro lost 0.2 % from 5 month high, after risk rating agency Moody’s cut the Anglo Irish Bank’s ratings to Baa3. This was a downgrade of 3 notches, meaning Irish debt is considered to be graded just above junk status.

European banking sector at risk?

Some currency analysts start to worry about the European banking sector again after the downgrade. At the (more…)

Tags: EUR, EUR/USD, Euro

Published in Euro, News | No Comments »

Monday, June 21st, 2010

Asian shares are rising and the euro seems to be about to turn upward after China’s central bank, The People’s Bank of China (PBoC), announces they will accept an increasing flexibility in exchange rates. Read more about the new Chinease currency policy below.

Gradual upgrade of Yuan

China’s central bank announced there will be a gradual easening of the local currency, Yuan. This is something many investors, Americans in particular, been waiting for a long time. Risk Appetite seemed rapidly increasing, and several stock (more…)

Tags: currency policies, EUR, EUR/USD, Euro

Published in Uncategorized | No Comments »

Tuesday, April 13th, 2010

A stronger demand then previous t-bill auctions, made the euro gain slightly against the main trading partners on Tuesday.

Government t-bill auction received $780 million euros

Today’s auction was attracting double as much capital as the last time. The treasure bills sold had a lenght of 26 weeks at a yield of 4.55 %. Greece also offered t-bills with a lenght of 52 weeks, with a yield of 4.85 %.

Euro rise against Dollar & Sterling Pound

It seems like euro forex traders were happy about the successful t-bill auction. During the afternoon, the Euro have risen considerable against several other currencies.

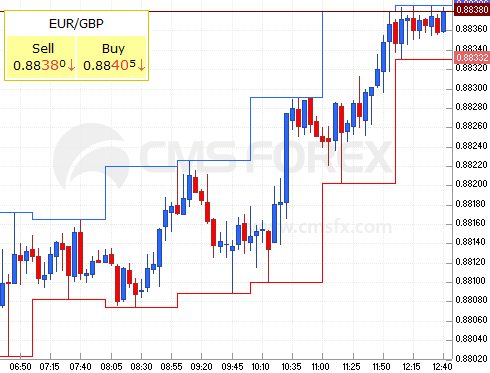

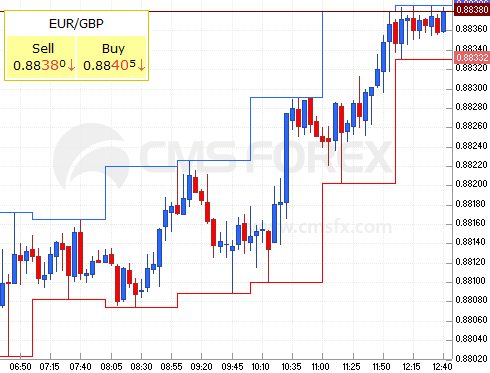

Against the Dollar (EUR/USD) from 1.3626 to 1.3573, and against the Pound Sterling (EUR/GBP) from 0.8808 to 0.8839.

euro - us dollar, 13th of April

Intraday graph, Euro against US Dollar above. (See more dollar graphs here)

euro - sterling, 13th of April

Intraday graph, Euro against Pound Sterling above. (See more Euro graphs here)

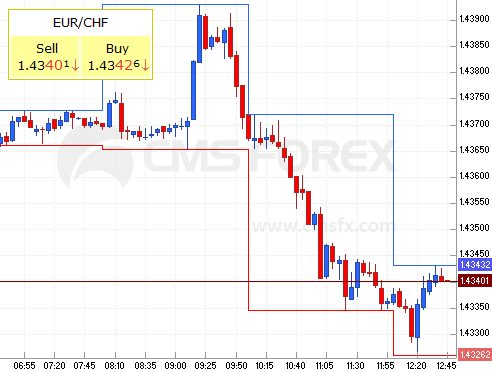

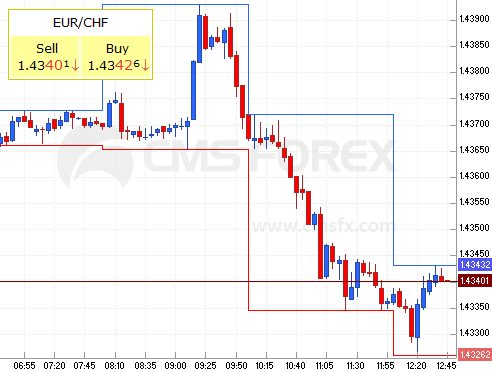

Finally, the Euro against the Swiss Franc (EUR/CHF) went from 1.4390 to 1.4334.

euro - franc, 13th of April

Intraday graph, Euro against Swiss Franc above.

Or why not check our some more Euro graphs.

Where do you think the Euro is heading in the coming weeks?

Tags: EUR, EUR/CHF, EUR/GBP, EUR/USD, Euro, euro rise, swiss franc, t-bills

Published in Dollar, Euro, Franc, Pound | No Comments »