Posts Tagged ‘us dollar’

Monday, January 23rd, 2017

On 21 January, Donald Trump was inaugurated as the president of the US. Though Trump has been lauded as the most ‘business focused’ president, this has not hitherto materialised in definite fiscal policies. As such, there has been a climate of uncertainty amongst Forex traders and this has materialised in a sense, since January 21st, that the dollar may be at risk.

Why might the dollar be at risk?

The uncertainty about the Trump administration’s fiscal policy has led some traders to worry that this could destabilise the dollar. Often all that it takes is a lack of confidence in the dollar for it to start to fall as traders turn to other markets and currencies as securer forms of investment.

(more…)

Tags: Donald Trump, inauguration, trading policy, us dollar, usa president

Published in News, Political, usd | No Comments »

Tuesday, December 22nd, 2015

All eyes within the online Forex trading market have been focused upon the performance of the dollar in relation to the recent interest rate hike enacted by the Federal Reserve. What is interesting to note is that many investors expected the value of this currency to strengthen significantly when compared to major counterparts such as the pound and the euro.

After a short and somewhat disappointing rally, the dollar has failed to exhibit any real strength. Many Forex analysts believe that this lack of upward momentum signals the continued sensitivity of this currency; particularly in terms of the final two weeks of 2015. However, there may be another reason why the dollar is failing to perform even while the price of commodities continues to fall.

(more…)

Tags: Federal reserve, Interest rates, us dollar

Published in Political, Statistics, usd | No Comments »

Wednesday, June 12th, 2013

One of the dominating forex news stories centres around the relationship between the US dollar and the Japanese Yen. We have seen a rally, albeit perhaps briefly, against the dollar when online trading analysts learned that the Bank of Japan has not modified their domestic monetary policy as was moderately expected.

One of the dominating forex news stories centres around the relationship between the US dollar and the Japanese Yen. We have seen a rally, albeit perhaps briefly, against the dollar when online trading analysts learned that the Bank of Japan has not modified their domestic monetary policy as was moderately expected.

This decision was defended by the governor of the central bank when he stated that there is less volatility in the government bond markets than previously. This announcement led to the dollar declining 1.78 percent in comparison to the Yen during the American trading session on Tuesday. Some online traders and forex brokers believe that this leveraging of Japan’s currency and the resultant decline in equities may attract investment from abroad.

(more…)

Tags: bank of japan, Goldman Sachs, japanese currency, us dollar, USD/YEN, Yen

Published in AUD, Central Banks, Dollar, Yen | No Comments »

Tuesday, January 15th, 2013

It seems that the new year has once again brought the bears out in regards to the latest online forex trading sentiment. The Euro has lost any previous gains made against the dollar due to a larger fall in European Union industrial output than previously predicted.

It seems that the new year has once again brought the bears out in regards to the latest online forex trading sentiment. The Euro has lost any previous gains made against the dollar due to a larger fall in European Union industrial output than previously predicted.

This statistical pullback is highlighted by the continued record-high unemployment in countries such as Spain and Greece. Although unemployment remains one of the most bearish economic barometers for the Euro, weak private sector output serves to further illustrate the fragile state of this multinational economy.

(more…)

Tags: ECB, EUR/USD, European Central Bank, us dollar

Published in Dollar, Euro, Political, usd | No Comments »

Monday, November 5th, 2012

The big story hanging over Forex traders and anyone else with an interest in the economic future should see its final resolution in the coming few hours. Who will be in charge of the world’s largest economy?

The big story hanging over Forex traders and anyone else with an interest in the economic future should see its final resolution in the coming few hours. Who will be in charge of the world’s largest economy?

The markets wait with baited breath for the decision of the US electorate, and the impact on the US dollar is opaque, although it did gain ground against the Euro and Sterling in the run up to polling day.

(more…)

Tags: us dollar, usa president, white house

Published in Dollar, usd | No Comments »

Thursday, August 23rd, 2012

In the latest forex news, the US dollar has slid considerably in comparison to other major currencies.

In the latest forex news, the US dollar has slid considerably in comparison to other major currencies.

While earlier this month many forecasts were bullish regarding the dollar’s upward trend, analysts have now scaled off this position and are taking a more contemplative approach.

Indeed, the dollar may slide further as is possibly indicated by the relative strength index (RSI) which appears to be setting the stage for a downward trend in the weeks to come. This is especially relevant considering that the Jackson Hole Economic Symposium is on schedule for the following week.

Although the bearish stance for the dollar may continue temporarily, should chairman Bernanke not hint at another round of QE3, sentiments may begin to reverse.

(more…)

Tags: Dollar, EUR, EUR/USD, Euro, outlook, United States, us dollar, USA, usd

Published in Currencies, Dollar, Euro, usd | 1 Comment »

Tuesday, July 24th, 2012

The week ahead looks to highlight concerns underpinning the European sovereign debt situation. The main story still is that of volatility on the European market; the single currency’s future viability questioned by many traders worldwide.

Spain is becoming more and more of a concern

The concerns with Spain’s ability to manage a flailing economy have grown since the IMF rescue package was approved. Spanish yields have tipped well over seven percent, trading at 7.39% after hitting a European-era high of 7.56%. Attempting to mitigate further volatility, Spain has banned short selling for three months while Italy, feeling the effects as well has banned short selling financials for one week. There are now fears that Spain may indeed seek a full bailout, as regional governments have begun to express concern for their ability to manage internal debts. Spanish and Italian bank shares were the worst hit followed closely by their domestic indices; the Ibex at one point dropping nearly five percent.

The concerns with Spain’s ability to manage a flailing economy have grown since the IMF rescue package was approved. Spanish yields have tipped well over seven percent, trading at 7.39% after hitting a European-era high of 7.56%. Attempting to mitigate further volatility, Spain has banned short selling for three months while Italy, feeling the effects as well has banned short selling financials for one week. There are now fears that Spain may indeed seek a full bailout, as regional governments have begun to express concern for their ability to manage internal debts. Spanish and Italian bank shares were the worst hit followed closely by their domestic indices; the Ibex at one point dropping nearly five percent.

Greece’s debt reduction

Furthermore, creditors are expected to begin auditing Greece’s progress on debt reduction. This audit determines whether the country is to be approved for an additional 31.5 billion euros. With political and social unease, a quickly shrinking economy and many investors questioning whether Greece will meet its August deadline, there has been speculation of true insolvency should their financial situation worsen.

Furthermore, creditors are expected to begin auditing Greece’s progress on debt reduction. This audit determines whether the country is to be approved for an additional 31.5 billion euros. With political and social unease, a quickly shrinking economy and many investors questioning whether Greece will meet its August deadline, there has been speculation of true insolvency should their financial situation worsen.

EUR/USD at two-year low

Because of these protracted jitters, the euro has fallen to a two-year low against the US dollar to trade at $1.2082. Furthermore, it has fallen to an eleven-year low to the Japanese yen. Below $1.20, many online Forex traders have taken a bearish stance.

Because of these protracted jitters, the euro has fallen to a two-year low against the US dollar to trade at $1.2082. Furthermore, it has fallen to an eleven-year low to the Japanese yen. Below $1.20, many online Forex traders have taken a bearish stance.

Euros long term survival

On the other hand, some Forex traders have taken the attitude that any position would have to be long due to such market volatility. This, of course, is under the assumption that the euro will remain in its current form. Indeed, the lack of real movement in the precious metals markets, traditional safe havens, illustrates that many believe the markets may incur still more losses in the near term. Nonetheless, taking a long position in the euro may indeed be one of the few hedges against what remains as the most volatile era for decades.

On the other hand, some Forex traders have taken the attitude that any position would have to be long due to such market volatility. This, of course, is under the assumption that the euro will remain in its current form. Indeed, the lack of real movement in the precious metals markets, traditional safe havens, illustrates that many believe the markets may incur still more losses in the near term. Nonetheless, taking a long position in the euro may indeed be one of the few hedges against what remains as the most volatile era for decades.

Tags: debt reduction, EUR, EUR/USD, Euro, greece, IMF, spain, us dollar, usd

Published in Crisis, Dollar, Euro, Political | No Comments »

Monday, June 18th, 2012

Greece’s recent general elections had much of the world holding their breaths as the fear that an anti-Eurozone party would come out victorious. The doomsday scenario many feared was that Greece would revert to the drachma and cancel its bailouts, leading to massive losses for the Eurozone as well as the potential for an even greater disaster, with Spain and Italy teetering on the edge. Fearing excessive volatility on the markets some online Forex trading brokers even shut down private trading on Sunday, the 17th of June.

Greece’s recent general elections had much of the world holding their breaths as the fear that an anti-Eurozone party would come out victorious. The doomsday scenario many feared was that Greece would revert to the drachma and cancel its bailouts, leading to massive losses for the Eurozone as well as the potential for an even greater disaster, with Spain and Italy teetering on the edge. Fearing excessive volatility on the markets some online Forex trading brokers even shut down private trading on Sunday, the 17th of June.

While the “end of the Eurozone” scenario did not come to pass as the pro-Eurozone (more…)

Tags: Euro, greece, Greek elections, us dollar

Published in Dollar, Euro, Political, usd | No Comments »

Wednesday, September 15th, 2010

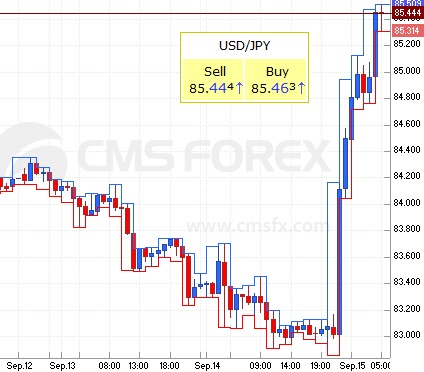

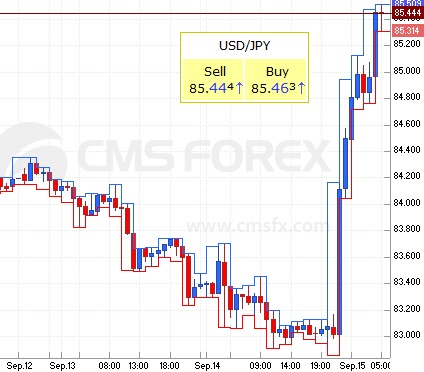

As we previously predicted it became inevitable for Bank of Japan (BOJ) to hold back its plans for intervention. JPY/USD went from 83 yen per dollar to 85.47 shortly after the intervention.

Strong yen – harmful for Japanese economy says Noda

Early this morning (9:30 ET) Yen reached a new 15-year high. This time, Bank of Japan was quick to intervene in the currency markets, selling yen in exchange for us dollars, after a week of possible intervention warnings. This intervention was made to counter the adverse impact of the strong yen, and was the first official intervention in the currency market since 2004.

“We conducted the intervention in order to avoid excessive movement in the currency market. The Bank of Japan will continue to (more…)

Tags: bank of japan, central bank interventions, Dollar, japanese currency, us dollar, USD/JPY, Yen, yen dollar

Published in Central Banks, Yen, usd | No Comments »

Saturday, September 4th, 2010

The yen surged to 15-year low on Friday against the dollar as fading confidence for the global economy have risen demand for the Japanese currency.

Will Bank of Japan intervene?

The latest move raised currency speculation of the Japanese central bank intervening in the forex market, which is rather uncommon (more…)

Tags: bank of japan, Dollar, us dollar, USD/JPY, Yen, yen dollar

Published in Carry Trading, Central Banks, Yen, usd | 1 Comment »

Wednesday, August 25th, 2010

The outlook for US Dollar have been going down, down and down against the Yen. Is it time for a turn-around soon?

New Economic Slowdown?

After the latest key U.S economic data was released, investors was first seriously concerned about the US economy showing, when July showed 27 % slowdown of previously owned U.S homes. But later, many forex investors insted became worried about the world economy instead and dollar started to rise again against many major currencies.

At the same time, Nikkei 225 rose to a 15-month low, while the Japanese currency become even stronger – 84 yen per USD. Yen is currently at its strongest value against USD this decade. Lets see how things move forward in the end of the week.

Tags: Dollar, japanese currency, us dollar, usd, Yen

Published in Data providers, Yen, usd | No Comments »

Thursday, August 19th, 2010

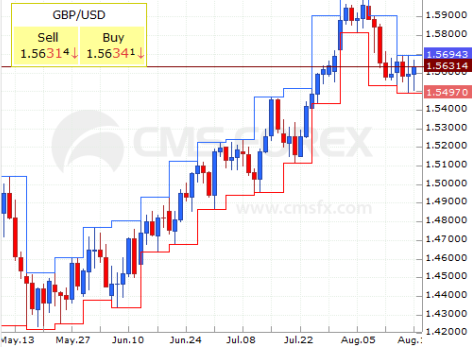

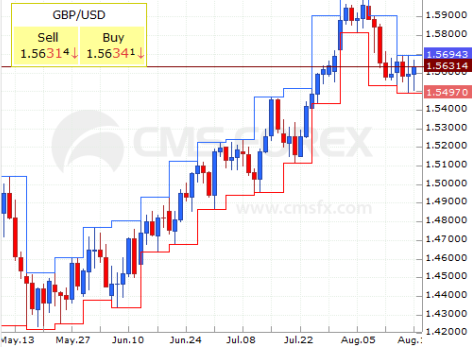

Sterling Pound against US Dollar is now in an up-trend after bottoming at 1.4425. How long will it continue? Let us look at the latest currency graph for GBP/USD.

Current intraday support levels are at 1.5589 and 1.5710, while weekly resistance levels are at 1.6460 and 1.70. It’s no secret that many analysts expect Sterling to rise against the dollar. If the US economy continue to show poor statistics, we believe GBP will rise sooner rather then later.

What do you think about the latest strength for GBP? Will it continue or break down?

Tags: Dollar, GBP, GBP/USD, Pound, pound sterling, us dollar, usd

Published in Dollar, Pound | 1 Comment »

Tuesday, May 11th, 2010

After a few days of discussions, many observers believe Tories and Liberal Democrats are forming a coalition government in United Kingdom. Currency analysts are now relieved that Gordon Brown seems to step down as Labours leader from September this year.

The new government are likely to cut borrowing sooner then a Labour government would and in general, it should do well for the economy and the british currency. Forex analysts already predict a hung parliment between conservatives and liberal democrats and they seem to like it – pound sterling rose by almost 1 % today. Interest rates (more…)

Tags: conservatives, Dollar, english economy, GBP, GBP/USD, gordon brown, liberal democrats, pound sterling, tories, us dollar

Published in Interest rates, Political, Pound, usd | No Comments »

Friday, April 2nd, 2010

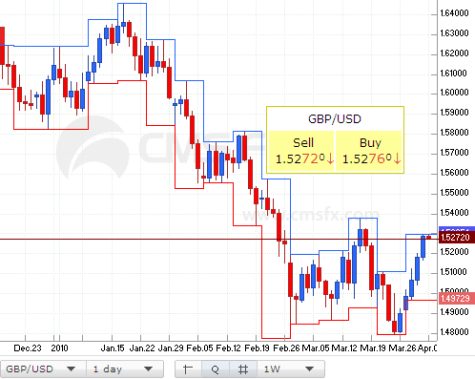

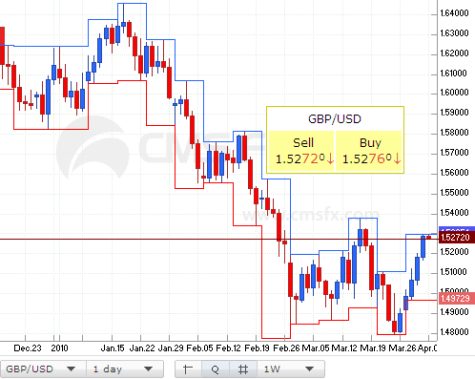

The pound sterling has been declining during most of this year, but maybe we are about to see a turning point now?

As you can see in the GBP minute graph, the Pound Sterling have been increasing against US Dollar before Easter holidays starts.

In the longer forex charts for GBP/USD, it looks like the GBP (more…)

Tags: GBP, GBP/USD, Pound, pound sterling, us dollar, usd

Published in Pound, usd | No Comments »