Elliott’s Wave Theory

Trading Forex with Technical Analysis Using Elliott’s Wave Theory

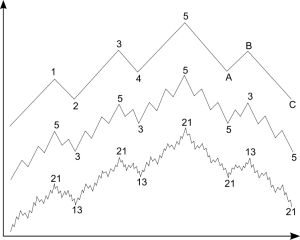

Considering the sheer size of the Forex market, it is of no surprise that numerous methods have been developed in an attempt to capitalise on various movements and trends. Of these disparate methodologies, one commonly used is known as Elliott’s wave theory. Developed by Ralph Nelson Elliott, this principle states that financial markets move in patterns of five ascending waves followed by a recorrection of three descending waves or vice versa (five descending followed by three ascending). Therefore, depending on where one finds himself in this model, subsequent patterns can be predicted with relative reliability and the Forex trader can use this theory to invest at very specific times.

Considering the sheer size of the Forex market, it is of no surprise that numerous methods have been developed in an attempt to capitalise on various movements and trends. Of these disparate methodologies, one commonly used is known as Elliott’s wave theory. Developed by Ralph Nelson Elliott, this principle states that financial markets move in patterns of five ascending waves followed by a recorrection of three descending waves or vice versa (five descending followed by three ascending). Therefore, depending on where one finds himself in this model, subsequent patterns can be predicted with relative reliability and the Forex trader can use this theory to invest at very specific times.

For additional clarity, this theory states that price direction moves in five waves in favor of the larger trend followed by three waves contrary to it. If we then consider an uptrend, it can be defined here as a five wave advance followed by a three wave decline. Conversely, a downtrend would be seen as a five wave decline followed by a three wave reversal. Interestingly enough, this wave pattern exhibits itself on charts of varying time spans; from monthly to daily price ranges. A method widely practised is to use Elliott waves to determine long-term market trends.

However, of considerable interest to traders is the reliability of these waves to predict short-term reversals, otherwise known as the troughs between the ascending and descending peaks. Even so, although this pattern remains constant, it is also a well-known fact that rarely does a full Elliott wave cycle neatly equate to the five-to-three scenario. For this reason, many traders consider interpreting the wave count as much of an art as a science.

Of particular importance regarding Elliott waves is the pivotal role online Forex trading algorithms can provide for the active trader. Whether using Forex trading robots or third-party software, today’s traders can more accurately predict the movement and timing of these waves. By knowing where a price will retrace along the course of this system, one can establish entry and exit points with relative reliability.

Traders first develop a strategy for determining an Elliott wave count (the number of peaks and troughs which represent a full cycle). Only then can the trader anticipate where a fifth wave will begin (signaling a reversal). Once again, this can be achieved through software or personal strategy. Generally, other technical indicators are used to confirm or deny such a trend. Finally, one determines a stop-loss point and executes an order. Especially when combined with one or more additional market indicators, the Elliott wave theory can be a powerful addition to a trading strategy.

>> Read more about other instruments to do Technical analysis