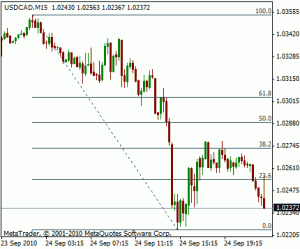

Fibonacci retracement

Trading Forex with Technical Analysis Using Fibonacci

Among the numerous technical instruments used by traders to determine movements in the Forex market, a specific system called Fibonacci Retracements has become quite popular. It will prove useful to examine in some detail what, exactly, Fibonacci Retracements are and how they can apply to a successful trading strategy.

Among the numerous technical instruments used by traders to determine movements in the Forex market, a specific system called Fibonacci Retracements has become quite popular. It will prove useful to examine in some detail what, exactly, Fibonacci Retracements are and how they can apply to a successful trading strategy.

Fibonacci Retracments are points in the market where currencies or stocks will “retrace” their direction after a large movement. This analysis can work on both short and long-term time frames. Think of these as instances where a price will move in the opposite direction before recorrecting and following its previous course. It is important to note that this contrary movement loses energy quickly and will therefore not be as large or as sustained as the general move itself. A good way to visualise this idea is to imagine a mountain; the ridges approaching a summit on either side contain peaks and valleys smaller than the entire slope of the mountain. Chartists view this data in the same fashion.

Interestingly enough, Fibonacci ratios are found throughout nature and can be observed in nearly all areas of organic sciences. The numbers themselves are derived from adding the previous two together to determine the next, for instance 1+1=2, 2+1=3, 3+2=5 and so on. Traders who follow these ratios claim that not only can this pattern be found in nature, but also in the markets. Of particular note here is that this approach is very mathematical in nature and like most algorithmic systems is not always 100 percent accurate.

In order to profit using Fibonacci Retracements in trading, it is necessary to develop a general “feel” for short and long-term market movements. For the chartist, this may be as simple as examining a specific time period and noting that a large move has already happened and ended. Immediately after this scenario is when the trader would look to take action; that is, when a retracement is imminent. Other ways can be to observe stochastics leveling off or to search for certain candlestick formations which are indicative of the end of a significant upward or downward trend.

Notwithstanding some of the methods above, to properly utilise the Fibonacci system one needs to become adept at interpreting Forex charts. Normally, this means spending a considerable amount of time gaining experience in predicting movements. Thereafter, one can begin to apply the knowledge of this data to actively trade. Of the abundant technical systems currently used, understanding Fibonacci Retracements requires both patience and time. Only after can the trader expect to profit with this method of analysis.

>> Read more about other technical signals useful when doing Technical analysis