Weakened Euro continues

Weakened Euro continues

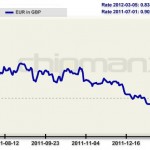

The recent financial turmoil for the Euro continues. Despite extensive funding programs from the European Central Bank, which was presented on March 1st, the EUR currency fell further against both the Japanese Yen (JPY) and the American Dollar (USD).

A lot of efforts

The efforts to curb the crisis in the Euro-area is extensive. The European Central Bank conducted a variety of actions today to prevent crisis from happening, such as Ireland and Greece. In total, a staggering sum of 530 billion Euros was partitioned to various Central Banks around the Euro-zone. However, this did not stop investors from raising their eyebrows. Many expected the currency to strengthen, however that did not happen. For a while, the relation between the EUR and USD was as low as 1.3400. That number slightly increased during the afternoon of March 1st.

The EUR fell worse against the JPY, the Japanese Yen. The Euro fell as much as 90 points before the drop was lifted slightly.

Risky currency

The Euro, despite the low valuation, is still considered a risky currency. The value is difficult to assess and there are still many countries in the Euro-area at risk of falling into the “Greece-trap”. The countries that already have been put to test, such as Ireland, may not yet have fully escaped the crises. These clouds of worry may lead to further

problems for the Euro, and the confidence in it. The large dependence of oil in the EU is also not a factor in favor of the Euro at present. The price of oil continues to increase, due to concerns of the developments in Iran.

It may worsen the crisis in the EU countries and therefore provide additional strain on the Euro.

The relationship between the USD and the EUR

How the Euro will stand in the future will partly depend on what has happened recently in the US. Several significant reports are expected in the near future. This includes the unemployment reports and the all-important manufacturing index. In addition, the Federal Reserve Chairman is planning to hold a speech, something that tend to be very important for confidence in the economy and not at least the Dollar.